Financial Assurance & Endowments in Mitigation Banking

May 12, 2020

Hunter’s Point South Waterfront Park Featured in “The Thin Green Line” Article

May 22, 2020Endowment Investing in a Low Interest Rate Environment

by Russell Silberstein

The economic fallout from the COVID-19 pandemic has been extensive. This blog is about how this might affect mitigation bankers and Land Trusts or non-profit conservators of restored lands. One economic area that has been particularly impacted has been the fixed income (or bond) market and the associated collapse in interest rates. The decline in interest rates will have a profound impact on investment returns and will have an especially profound impact on fiduciaries responsible for the long-term investment management of endowment funds. As a result, there will likely also be dramatic ramifications for the mitigation banking and land management community.

In a typical mitigation banking project, after success criteria has been met, usually around five years after project construction, responsibilities for long-term site management is typically transitioned to a land trust or another group. These long-term managers rely on revenue earned from an endowment dedicated to the site to finance the perpetual operation. This means that the nature of endowment investing requires the asset manager to invest the pool of capital and generate a return sufficient to satisfy the operating and maintenance needs of the underlying long-term management of the mitigation project. For example, in an investment environment where prevailing interest rates (a proxy for investment returns) are 5%, and the operating expenses of a project are $100,000 per year, an endowment pool of $2,000,000 will be required to meet the operating expenses. However, if interest rates decline to 2% the same $100,000 of operating expenses require an endowment pool of $5,000,000.

As this example shows, the returns will dramatically affect the principal needed up front.

Inflation is another consideration for environmental endowment managers. The above stated returns are before any inflationary effect on operating and maintenance expenses. In the above latter example assuming the same 2% return but now with inflation at 2%, the results would be a growth in operating expenses from $100,000 / year to $121,899 / year in ten years. However, the $5,000,000 is still only generating the same $100,000 /year. The outrun inflation the investment manager would have to generate returns in excess of 2%, or the endowment would need to be seeded with capital in excess of the original $5,000,000.

So, between inflation and the investment environment how should the endowment manager operate?

An often used “fire and forget” investment approach of simply purchasing a CD or placing the funds in a passive portfolio of bonds will no longer be sufficient. After accounting for low interest rates, inflation, and the asset manager’s fee it will be extremely difficult to generate investment returns (cash flow) to meet the needs of long-term managers based on a small endowment.

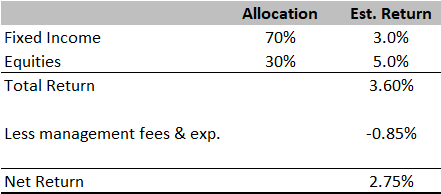

Let us use a real time example. Assuming a conservative allocation between Fixed Income and Equites of 70% / 30%, one can expect a net return after fees and expenses of 2.75%.

The 2.75% return is barely enough to keep up with inflation which has averaged 2.35% over the past ten years. The consequences of not generating returns in excess of inflation means that in future years one can expect the operating and maintenance costs of the project to exceed the cash flow being generated by the pool of investment capital.

What is the solution?

Assuming we remain in an extremely low interest rate environment for many years, then an adjustment to the traditional “fire and forget” approach will be required. Investment managers overseeing endowment funds will need to be creative, resourceful, and disciplined. Most importantly they will need to strike the right balance between generating attractive investment returns, but at the same time manage risk to ensure the long-term preservation of capital.

For mitigation bankers, the new reality could be much larger endowments. And for the long-term manager, there may be a new reality of making do with less cash. The greatest challenge is perhaps on the regulator who must understand the capital markets and approves both the long-term management plan as well as the size of the endowment. But, the days of assuming that a pool of capital can earn a 5-7% return are over for now, so regulators will have to be realistic with their assumptions on the endowment capital required to implement any long-term management program.

Eco Endowment Solutions creates custom portfolios for mitigation bankers and non-profit land trusts and other land managers to help them achieve their investing goals.